Buying a home is one of the biggest financial decisions people make. A Mortgage Calculator helps you estimate your monthly payments, total interest, and repayment schedule before applying for a loan. This tool available on Calculatorr.com is designed to simplify home financing decisions and empower users to plan wisely.

A mortgage is a long-term loan used to purchase property, where the borrower repays principal and interest over a fixed period. The total amount you pay depends on factors like loan size, interest rate, and loan term. Understanding these variables can save thousands in interest and help you select the best mortgage option.

How the Mortgage Calculator Works

The Mortgage Calculator on Calculatorr.com is simple and intuitive. It only requires a few key inputs:

-

Loan amount – The total money borrowed to purchase the property.

-

Interest rate – The annual percentage charged by the lender.

-

Loan term – The duration of the loan, usually 15, 20, or 30 years.

-

Down payment (optional) – The upfront amount you pay.

-

Property tax or insurance (optional) – If included, the calculator can estimate total monthly costs.

After entering the data, the calculator instantly displays:

-

Monthly payment amount

-

Total repayment amount

-

Total interest paid

-

Amortization schedule

You can test different combinations to find the balance between affordability and total cost.

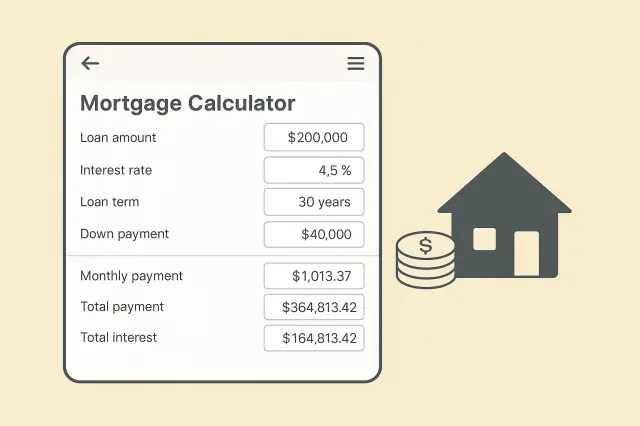

Example: Real-Life Case

Imagine buying a house worth $250,000 with a 20% down payment ($50,000). You take a loan of $200,000 at a 4.5% annual interest rate over 30 years.

By entering these values into the Mortgage Calculator, you get:

-

Monthly payment: $1,013.37

-

Total interest paid: $164,813.42

-

Total amount paid: $364,813.42

This breakdown shows how interest accumulates over time and why comparing loan terms is crucial. Reducing the term to 20 years increases the monthly payment but saves over $65,000 in interest.

Benefits of Using a Mortgage Calculator

Helps with budgeting

Knowing your future monthly payments lets you plan your finances realistically. You can see how changes in interest rates or loan amounts affect affordability.

Compares different loan options

You can evaluate 15-year vs. 30-year mortgages instantly. The calculator reveals how shorter terms reduce total interest, helping you make smart financial choices.

Reveals true cost

Including taxes, insurance, and HOA fees gives you a full picture of what homeownership will cost monthly and annually.

Encourages early repayment

If you add extra monthly or yearly payments, you can see how much faster you could pay off your mortgage and how much interest you save.

Understanding Key Mortgage Terms

| Term | Description |

|---|---|

| Principal | The original amount borrowed. |

| Interest | The lender’s charge for using their money. |

| Amortization | The process of paying off the loan through regular installments. |

| APR (Annual Percentage Rate) | Includes interest plus fees, showing the real cost of borrowing. |

| Equity | The portion of your home you truly own after deducting what you owe. |

Knowing these terms helps you understand your loan offer and how the calculator’s numbers translate into real-life payments.

How to Use the Calculator for Smarter Decisions

Follow these steps when using the tool:

-

Start with your budget.

Determine how much you can afford for monthly housing costs, ideally under 30% of your income. -

Input different interest rates.

Compare current market rates. Even a 0.5% change can affect payments significantly. -

Experiment with loan terms.

Check 15-, 20-, and 30-year options to see which fits your long-term goals. -

Include additional costs.

Taxes, insurance, and HOA fees make a big difference in total expenses. -

Plan for extra payments.

Test how small additional monthly amounts can reduce your total interest.

Common Mistakes to Avoid

-

Ignoring closing costs. These can add thousands to your loan.

-

Underestimating property taxes and insurance. They impact your real monthly payment.

-

Assuming fixed interest rates. Adjustable-rate mortgages can change over time.

-

Not comparing lenders. Rates vary, and even small differences affect long-term costs.

Using the Mortgage Calculator regularly during your home search keeps you informed and financially prepared.

Who Should Use the Mortgage Calculator

This tool is ideal for:

-

First-time homebuyers exploring affordability.

-

Investors comparing mortgage options for multiple properties.

-

Homeowners considering refinancing or prepayment.

-

Real estate agents helping clients understand loan implications.

Related Tools on Calculatorr.com

If you’re planning your finances, you may also find these calculators helpful:

-

Loan Calculator – Compare different types of personal or car loans.

-

Investment Return Calculator – Estimate future value of investments.

-

Net Salary Calculator – Understand your income after taxes.

These tools complement the Mortgage Calculator, helping you make holistic financial decisions.

Why Use Calculatorr.com

Calculatorr.com offers:

-

Free and fast tools accessible worldwide.

-

Accurate calculations based on current financial formulas.

-

User-friendly interface for professionals and beginners.

-

Mobile-friendly design so you can calculate anywhere.

The Mortgage Calculator requires no registration and provides immediate results, ensuring a smooth experience for users.

Frequently Asked Questions

Is the Mortgage Calculator accurate?

Yes. It uses standard amortization formulas used by banks and financial institutions.

Can it calculate variable-rate loans?

You can approximate by adjusting the interest rate manually to reflect expected changes.

Does it include taxes and insurance?

Yes, you can add these to see your full monthly payment.

Is the calculator free?

Completely. No hidden fees or sign-ups are required.