Understanding the Mortgage Calculator

A mortgage calculator is an essential online tool for anyone considering buying a home or refinancing an existing loan. With it, you can estimate your monthly payments, understand how much house you can afford, and compare different loan terms without needing to be a finance expert. Our Mortgage Calculator at Calculatorr.com is designed to give you quick, accurate results that simplify your financial planning.

Why Use a Mortgage Calculator

Before committing to a loan, knowing the long-term cost is crucial. A mortgage calculator helps you:

-

Estimate monthly payments with different loan amounts and interest rates.

-

Understand the impact of down payments.

-

Compare different loan terms, such as 15 vs. 30 years.

-

Plan your budget with more accuracy.

Using this tool allows buyers to make informed decisions and avoid surprises after signing the contract.

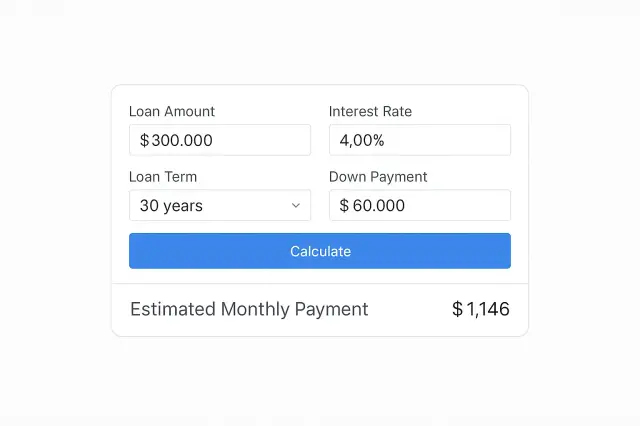

How to Use the Mortgage Calculator

Using our calculator is simple:

-

Enter the loan amount you need.

-

Input the interest rate offered by your lender.

-

Select the loan term (e.g., 15, 20, or 30 years).

-

Add the down payment if applicable.

-

Press calculate to see your estimated monthly payment.

The calculator instantly displays your payment breakdown, including principal and interest. Some users also combine it with our Net Salary Calculator to check affordability based on income.

Real-Life Examples of Mortgage Calculator Use

-

First-time buyers: Sarah wants to buy her first apartment. She uses the calculator to see if her monthly income can cover a $200,000 loan with a 4% interest rate over 30 years. The tool shows her she can manage it comfortably.

-

Refinancing: Mark considers refinancing his existing mortgage. By testing different interest rates, he finds out how much money he can save over the loan’s lifetime.

-

Budget planning: A couple uses the calculator to compare a 15-year and a 30-year mortgage. They discover that while the 15-year term means higher monthly payments, it saves them thousands in interest.

Benefits of Comparing Loan Scenarios

The mortgage calculator allows you to run unlimited simulations. This makes it easier to:

-

Test different down payment strategies.

-

See how small changes in interest rates affect long-term costs.

-

Decide between fixed-rate and variable-rate loans.

Common Mistakes to Avoid

Many people underestimate the importance of accurate inputs. To get realistic results:

-

Always check the exact interest rate offered by your bank.

-

Don’t forget additional costs like insurance and property taxes.

-

Recalculate if you plan to make extra payments.