What is a Mortgage Calculator

A mortgage calculator is an online tool that helps you estimate your monthly mortgage payments based on the loan amount, interest rate, repayment term, and other costs such as taxes or insurance. At Calculatorr.com’s Mortgage Calculator, you can quickly understand how much your home loan will cost and how it fits into your budget.

This tool is especially useful for first-time homebuyers, property investors, and anyone comparing different loan offers.

How the Mortgage Calculator Works

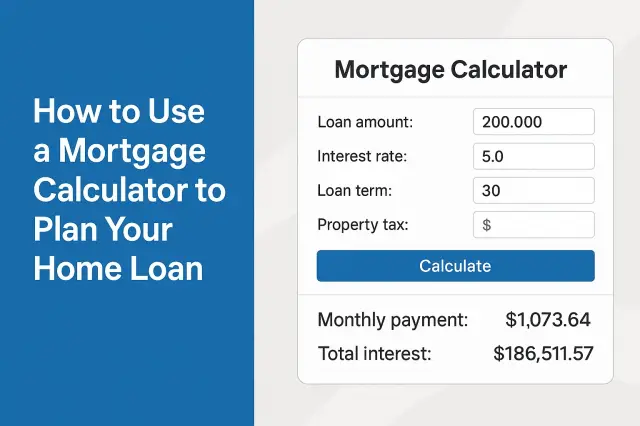

The calculator uses a simple formula to break down your payments into principal and interest. You only need to enter:

-

Loan amount: the money you borrow from the bank.

-

Interest rate: the annual percentage rate charged by the lender.

-

Loan term: the repayment period, usually 15, 20, or 30 years.

-

Extra costs: optional inputs such as insurance or property taxes.

With this information, the tool instantly shows you the monthly payment, total interest paid, and the overall cost of the loan.

Steps to Use the Mortgage Calculator on Calculatorr.com

-

Visit the Mortgage Calculator.

-

Enter the loan amount you plan to request.

-

Add the interest rate given by your lender.

-

Select the repayment term (in years).

-

Optionally, include taxes or insurance if applicable.

-

Click calculate to see your monthly and total costs.

Practical Use Cases

-

Comparing lenders: You can check how different interest rates affect your payments.

-

Budget planning: Estimate if a mortgage fits your monthly income. Try also our Net Salary Calculator to align income and expenses.

-

Refinancing decisions: See how changing loan terms could reduce your interest over time.

-

Investment analysis: Property investors can calculate returns considering mortgage costs.

Example Scenarios

-

A $200,000 loan at 5% interest over 30 years shows a monthly payment of around $1,073.

-

The same loan at 4% interest reduces the payment to about $955, saving more than $40,000 over the life of the loan.

These comparisons highlight why using the calculator is crucial before signing any agreement.

Advantages of Using the Mortgage Calculator

-

Quick and accurate results.

-

Easy to test multiple scenarios.

-

Helps avoid financial surprises.

-

Free and available online at Calculatorr.com.