Unlocking the Power of Compound Interest

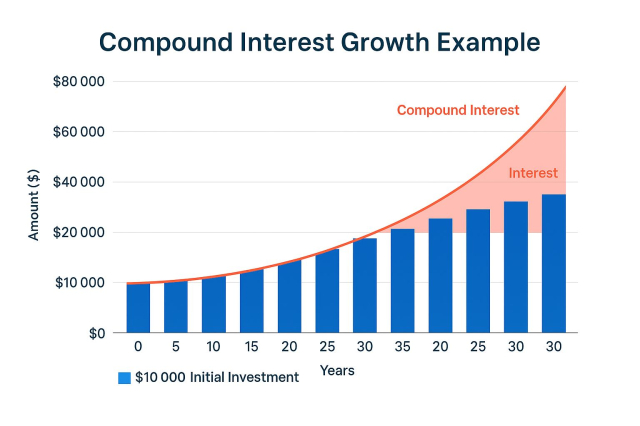

Compound interest calculator — a tool every savvy saver and investor should know about. Unlike simple interest, compound interest allows your money to grow faster by earning interest on both your initial deposit and the accumulated interest over time.

Whether you're building an emergency fund, saving for retirement, or investing in long-term financial goals, understanding compound interest can be your secret weapon. In this guide, we’ll explain how it works, why it matters, and how to use our free calculator to project your potential returns and make smarter decisions with your money.

What Is Compound Interest and How Does It Work?

Compound interest is the process by which your investment grows not only from the original amount (principal) but also from the interest previously earned. Over time, this creates a snowball effect, exponentially increasing your wealth.

Difference Between Simple and Compound Interest

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Calculation | Based on principal only | Based on principal + accumulated interest |

| Growth Type | Linear | Exponential |

| Long-Term Earnings | Lower | Higher |

Let’s say you invest $1,000 at 5% annual interest:

-

With simple interest, after 10 years, you’d earn $500.

-

With compound interest, compounded annually, you’d earn about $628 — without any additional contributions.

Benefits of Compound Interest in Your Finances

Compound interest can be a game-changer for your personal finances, especially when applied over long periods.

Real-Life Examples of Compound Growth

-

Scenario 1: Investing $5,000 annually for 20 years at 7% interest, compounded annually = $204,977

-

Scenario 2: Delaying investment by 10 years reduces the total to $101,073, with the same contribution.

As you can see, time is your best friend when it comes to compounding.

How to Use a Compound Interest Calculator

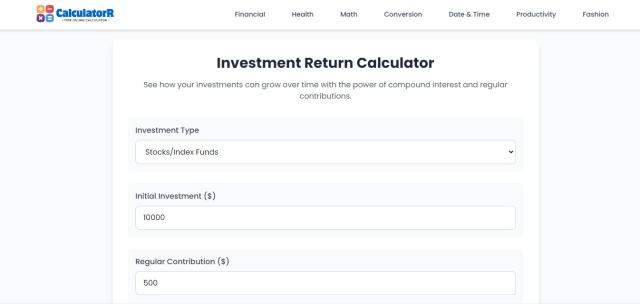

Using our online compound interest calculator is simple, yet it can offer deep insights into your financial potential.

Input Fields You’ll Need:

-

Initial investment (Principal)

-

Annual interest rate (%)

-

Investment period (Years)

-

Compounding frequency (Annually, Semi-annually, Quarterly, Monthly, Daily)

-

Additional contributions (optional)

Once you fill in these fields, the calculator will instantly show your total earnings and final amount.

Strategies to Take Advantage of Compound Interest

The earlier and more consistently you invest, the more you benefit from compound growth.

Best Practices for Maximizing Compounding Returns

-

Start Early: The sooner you invest, the more time your money has to grow.

-

Reinvest Your Earnings: Don’t withdraw your interest; let it accumulate.

-

Make Regular Contributions: Even small monthly deposits compound significantly over time.

-

Choose Higher Frequencies: Monthly or daily compounding yields better results than annual.

Use Our Free Compound Interest Calculator

Try different scenarios and visualize your future wealth. Experiment with contribution amounts, time frames, and interest rates to find your optimal strategy.

Alt text: Compound interest calculator with input fields and projected earnings graph.

Take Charge of Your Financial Future

Compound interest is one of the most powerful financial tools at your disposal. By understanding how it works and taking action today, you can build a strong foundation for your financial future. Use our compound interest calculator now and start maximizing your savings and investments with confidence.

Know all our financial calculators online.

Frequently Asked Questions (FAQ)

What is the formula for compound interest?

A = P(1 + r/n)^(nt), where:

-

A = final amount

-

P = principal

-

r = annual interest rate

-

n = number of compounding periods per year

-

t = time in years

Is monthly or annual compounding better?

Monthly compounding usually results in higher returns because interest is calculated more frequently.

What’s the difference between saving and investing with compound interest?

Saving offers lower but safer returns; investing can yield higher growth but involves more risk. Both benefit from compounding.

Can I use this calculator for retirement planning?

Yes, it’s ideal for estimating how much you’ll accumulate over time with regular contributions and compounding.

How long does it take to double my money with compound interest?

Use the “Rule of 72”: divide 72 by your interest rate. For example, at 6%, it takes approximately 12 years.